In a duel to remain the network provider of the Apple Card, Mastercard might have to prevail.

For pay networks, Apple Card might use Visa.

As Goldman Sachs enters the second Apple Card supplier, there hasn’t been a public debate over who will be the new Apple Card issuer, but a new fight is brewing between systems looking to take over from Mastercard. Apple is expected to move its Apple Card from Goldman Sachs at some point in 2013, but the company may also change payment networks while doing so. The walk is past due because Goldman Sachs had previously stated that it wanted to get rid of the Apple Card by November 2023. But, Apple may choose to enter a new lease with a different pay system before the card issuer changes. Mastercard is currently the system, but Visa and American Express are competing for the top spot, according to a statement from The Wall Street Journal. &# 13; According to reports, Visa has also offered Apple$ 100 million to get over as the payment system. That is a sizable amount that it has reserved for its biggest customers, like Costco. American Express allegedly attempting to take over Apple Card as both lender and community. Although the Amex CEO has previously indicated disinterested in Apple Card, adding the ability to get the system provider might close the deal. Apple can’t depart from Mastercard until 2026, according to &# 13;;. Even if Goldman Sachs does find a new lender, it will still take time to make the switch and does allow for some bargaining to be made about who the new network provider is. No formal announcements have been made in the past, and there is still no word on when or where the company will step in after Goldman Sachs. If Goldman Sachs is being so pressed to get free of Apple, expect techniques to get made immediately, even though it may take a few months before it all starts to unravel.

Stories of the Shire: A The Lord of The Rings Game – area tower and shared meals play information

Stories of the Shire: A The Lord of The Rings Game – area tower and shared meals play information  Pac-Man-inspired activity platformer Shadow Labyrinth launches July 18 on PS5

Pac-Man-inspired activity platformer Shadow Labyrinth launches July 18 on PS5  Masters of Light: Hand Tracking upgrade accessible today on PS VR2

Masters of Light: Hand Tracking upgrade accessible today on PS VR2  Baby Steps: hands-on review

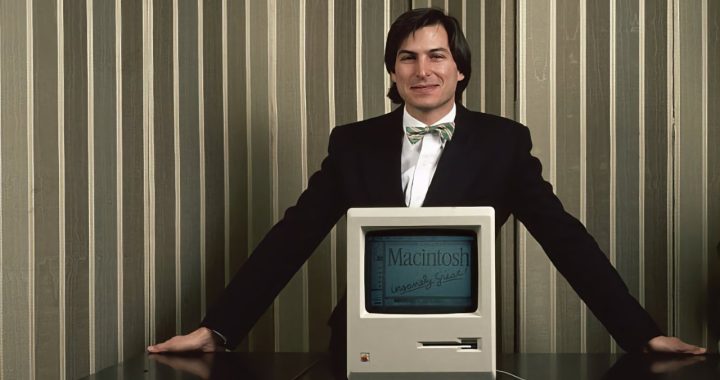

Baby Steps: hands-on review  If Apple hadn’t been established 49 years earlier, computing may be completely different.

If Apple hadn’t been established 49 years earlier, computing may be completely different.  Free VPN software with connections to China martial were hosted in Apple’s App Store.

Free VPN software with connections to China martial were hosted in Apple’s App Store.